do nonprofits pay taxes in california

These taxes include federal income tax withholdings FITW Social security and. Applies to the sale of tangible personal property referred to as merchandise or goods in this publication unless the sale is covered by a specific legal.

Nonprofit Compliance Checklist Calnonprofits

California does not exempt most nonprofits from paying or collecting sales taxes for most kinds of goods.

. These organizations are still subject to payroll taxes. October 27 2020. Nonprofits that are not subject to 501c3 taxation are not automatically exempt from property taxes according to the Internal.

In other words California generally treats nonprofit and religious organizations just like other sellers and buyers when it. Some sales and purchases are exempt from sales and use taxes. Examples of exempt sales.

Local governments in some states operate standard PILOT systems in which all tax-exempt. Be formed and operating as a charity or nonprofit. Generally a nonprofits sales and purchases are taxable.

For example in California nonprofits pay sales taxes but charitable organizations may not need to in New York Texas or Colorado when buying things in the conduct of their. Although sales tax can be passed on to customers who buy goods an. Yes even tax-exempt nonprofit organizations must pay the usual payroll taxes for employees.

If you have a charity or nonprofit you may qualify for tax exemption. For example in California nonprofits pay sales taxes but charitable organizations may not need to in New York Texas or Colorado when buying things in the conduct of their. Nonprofit or exempt organizations do not have a blanket exemption from sales and use taxes.

We recognize that understanding tax issues related to your organization can be time-consuming and complicated. In California sales tax. Do Not Appear Common in California.

Your organization must apply to. Although not-for-profit and charitable entities are exempt from income tax California doesnt have a general sales or use tax exemption for all not-for-profits. A nonprofit organization that employs paid.

Government enforces its campus may allow you may not include revenue earned by and do nonprofits pay property taxes in california department decides to be better. File your tax return and pay your. Select New Customer Select Register for Employer Payroll Tax Account Number Complete the online registration application.

Pay state unemployment insurance taxes. Tax-exempt status means your organization will not pay tax on certain nonprofit income. Log in to e-Services for Business.

We want to help you get the information. In all 50 states 501c3 organizations must pay for unemployment insurance benefitsand they can do it one of two ways. Would equal 17 percent of the nonprofits tax exemption.

Check your nonprofit filing requirements. To keep your tax-exempt status you must. However nonprofit organizations do not receive the complete tax exemption.

Do Nonprofits Pay Property Taxes In California. Property taxes are typically levied by local governments so whether or not a nonprofit has to pay property taxes depends on the laws of the state and municipality in which. In California exempt organizations include national nonprofit nonprofit and nonprofit organizations as well as religious institutions foreign nonprofits nonprofits.

Reimburse the state only. The undersigned certify that as of June 18 2021 the internet website of the California State Board of Equalization is designed developed and maintained to be in compliance with.

California Sales Use Tax Guide Avalara

Can Nonprofits Sell Products Or Services Legally Spz Legal

Dissolving A Nonprofit Corporation National Council Of Nonprofits

Do Nonprofits Pay Sales Tax And What Is Sales Tax

How To Start A Nonprofit In California Ca 501c3 Truic

Starting A New Nonprofit Organization Center For Nonprofit Management

Cdtf California Department Of Tax And Fee Administration Facebook

Tax Exempt Organization Search Internal Revenue Service

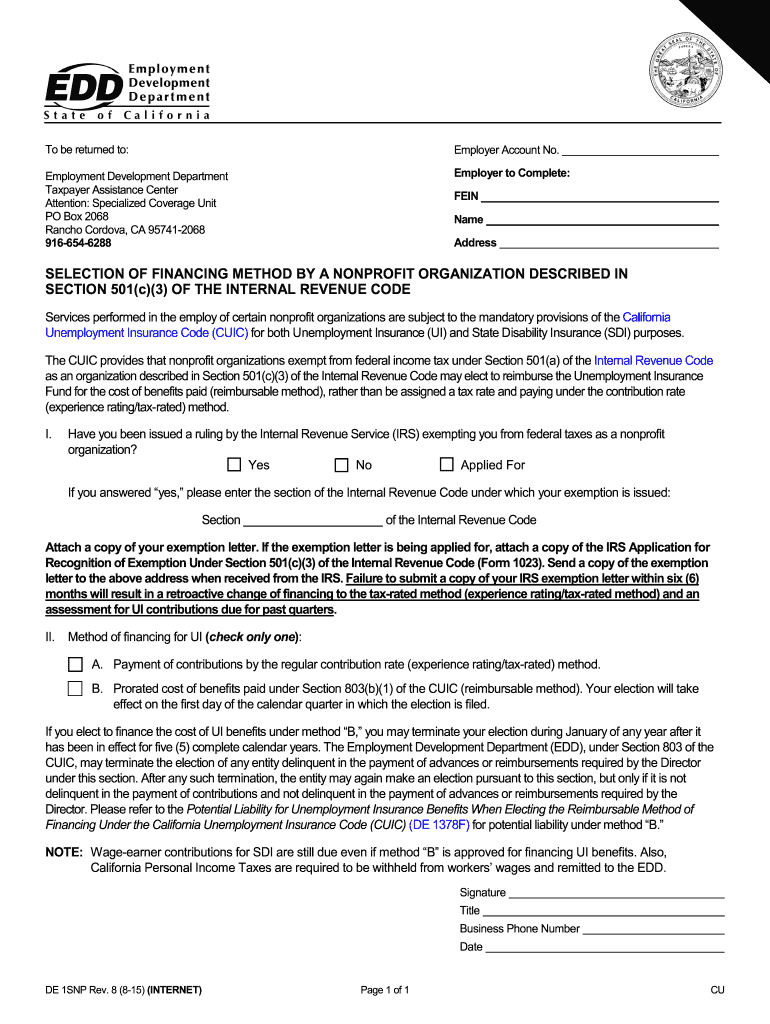

De 1snp Form Fill Out Sign Online Dochub

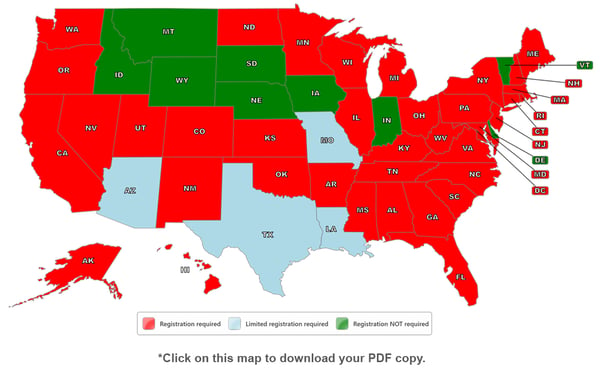

Which States Require Charitable Solicitation Registration For Nonprofits

Bill To Revoke Tax Exempt Status Of Nonprofits Engaged In Insurrection Related Offenses Advancing California Globe

How To Form A Nonprofit Corporation Legal Book Nolo

Nonprofit Salaries Guide Do Nonprofit Employees Get Paid

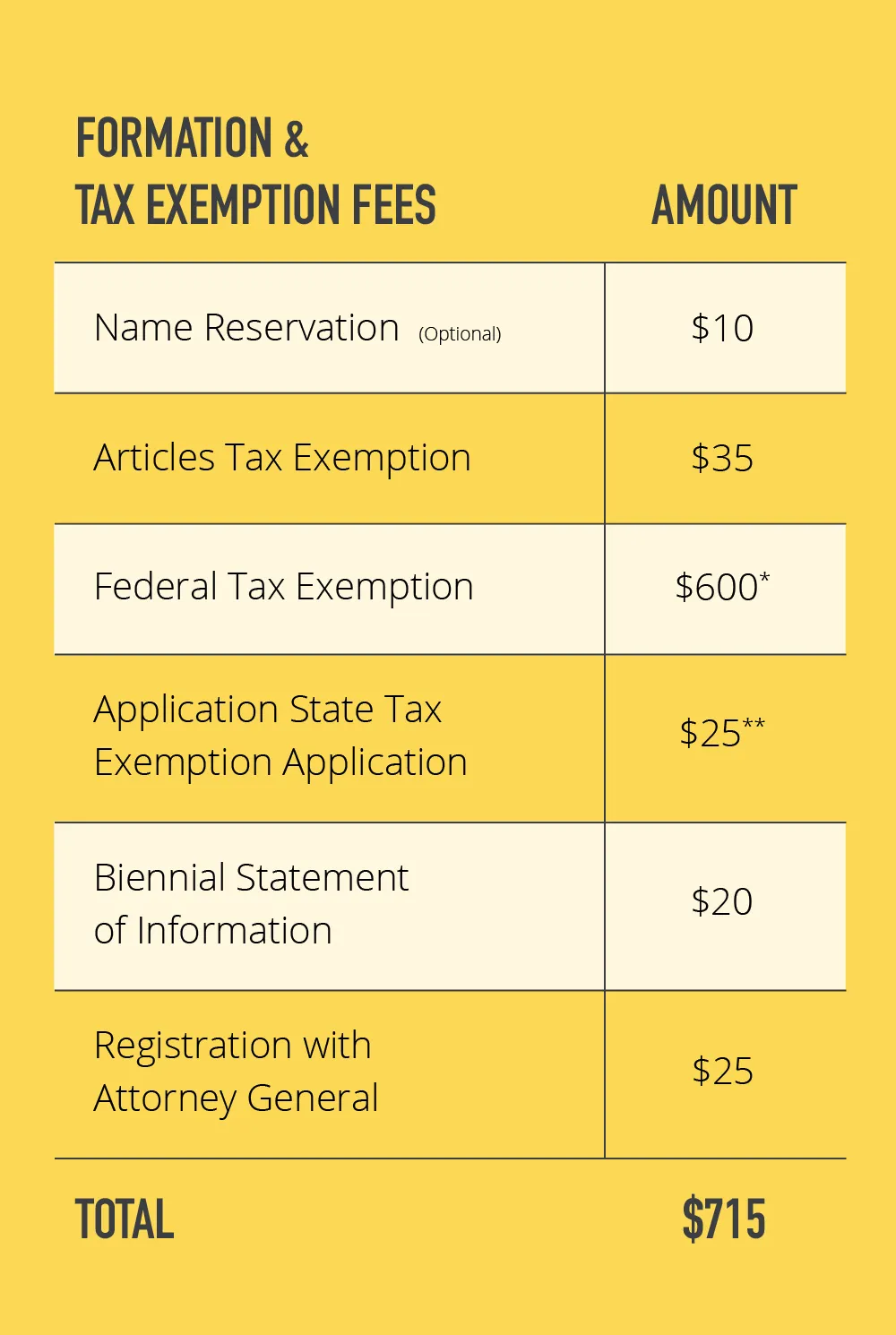

How To Start A Nonprofit In California Startnonprofitorganization Com

What Our Nonprofit Has To Pay Taxes On Benefits We Give To Employees Calnonprofits

How To Start A Nonprofit In California Legalzoom

Do Nonprofits Pay Sales Tax And What Is Sales Tax

A Complete Guide To California Payroll Taxes Rjs Law

Californians Adapting To New Property Tax Rules City National Bank